Hard Money Lenders Oregon

Secure financing for your next Oregon real estate investment

Hopkins is primarily designed to help borrowers who have equity in real estate but, for whatever reason, cannot qualify for conventional bank financing. Our asset-based private money loans provide the speed and flexibility you need to seize Oregon’s best opportunities.

Find the perfect financing for your strategy

Whether you’re looking for a loan on your own home or for an investment property, we have the real estate loans to help you achieve your goals.

Our most common loan products include:

Owner-Occupied Residential Loans (Idaho only)

We help homeowners who need a quick loan for a home they plan to live in. Get the financing you need without the red tape of a traditional bank loan.

Commercial or Residential Investment Loans

Whether it’s a fix-and-flip, a multi-family property, or a commercial space, we provide fast, flexible financing for your investment.

Construction or Development Loans

Secure the capital to build or develop a new property from the ground up. We see the potential in your project where conventional lenders don’t.

Bridge Loans

Bridge the gap between buying a new property and selling an existing one without missing a beat. Don’t let timing kill your next big deal.

Our other loan services

Hopkins Financial also offers a variety of other loan services to fit your needs. Our team can help you find the right solution for your unique situation.

The Hopkins advantage

Our approach focuses on the asset, not the red tape, making our hard money lending process the perfect solution for your next real estate project.

| Feature | Hopkins Financial Services | Traditional banks |

|---|---|---|

| Approval time | Seven to thirty days | 45-60+ Days |

| Basis for loan | Property value and potential | Borrower's credit and income history |

| Property types | All investment types | Conforming properties only |

| Credit requirement | No minimum score | 680+ FICO required |

Why our loans make financial sense

We know that hard money comes with higher rates and fees than a bank loan. But the most expensive loan is the one you can’t get in time.

Our speed and efficiency are your competitive advantage. It allows you to negotiate better terms, act like a cash buyer, and close on deals others can’t. Losing a $100,000 profit opportunity to save a few thousand dollars in interest is a trade you can’t afford to make.

We provide the certainty and speed you need to act decisively. That’s the real return on investment.

Frequently asked questions

How do you evaluate loan requests?

We assess the potential of the real estate project, including the exit strategy and market conditions. This asset-based approach allows for faster decisions and funding within a few business days. Unlike conventional lenders, private lenders prioritize the equity in the property and the borrower’s plan to invest wisely, making the entire process more accessible for borrowers facing challenges with traditional financing.

What are your typical interest rates and fees?

Our competitive rates and fees vary depending on the loan-to-value (LTV) rate, property type, and complexity of the deal. We believe in full transparency and will provide a clear term sheet upfront so you know all the costs before committing.

What is the minimum credit score you accept?

As an asset-based lender, we have no minimum score and focus solely on the equity in the property. Bad credit isn’t an automatic disqualifier for borrowers who have a solid real estate project and a clear exit strategy.

How fast can you really close a loan in Oregon?

We can fund fast, often in as little as seven to thirty business days from a completed loan application. In some cases, we’ve funded even faster. Our goal is to get you the money you need to secure your deal.

What documents do I need to get started?

Getting started is simple. All we need to issue a preliminary offer is your loan request with basic details about the property and your plan for it. The process is designed to be streamlined, without the endless paperwork of traditional financing.

Key insights for Oregon borrowers

Stay ahead of the market with our latest articles and guides.

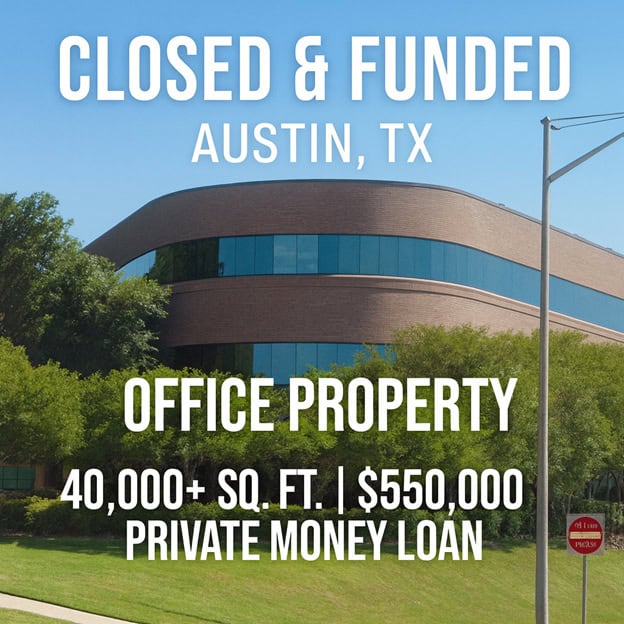

Closed & Funded: Hopkins Financial Powers $550,000 Private Money Loan for Austin, TX Office Acquisition

Strategic Financing for a Unique Opportunity Hopkins Financial is proud to announce the successful closing and funding of a $550,000 private…Read more

Financing Rural Idaho: Lending Beyond the City Limits

Idaho’s Wide-Open Opportunity — and the Financing Gap From Emmett to McCall, from Buhl to Melba, Idaho’s wide-open spaces continue…Read more

Secure your next investment with the help of Hopkins Financial Services

Get the speed, flexibility, and certainty you need to grow your real estate portfolio. Experience our exceptional service and efficient process today.