Hopkins Financial | Creative Real Estate Lending Since 1984

We don’t live in a box—because we don’t think like a bank.

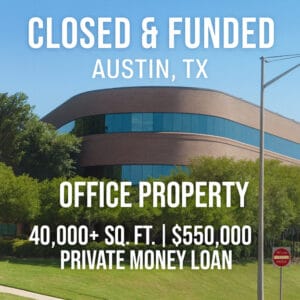

At Hopkins Financial, we specialize in private money real estate loans for properties and borrowers that don’t meet traditional guidelines. Since 1984, we’ve helped thousands of clients secure flexible funding when the banks say no.

We proudly serve all of Idaho, and any other state (subject to no licensing requirements). If your property or situation falls outside the box—good. That’s exactly where we work best.

What Is an “Unconventional” Property?

What Is an “Unconventional” Property?

Many of the best real estate opportunities don’t fit into the narrow criteria used by banks. Hopkins provides funding for non-conforming properties, including:

- Mobile or manufactured homes on land (including older units)

- Rural properties with well/septic or limited access

- Mixed-use buildings (residential + commercial spaces)

- Log cabins, tiny homes, or other unique construction types

- Vacant or partially improved land

- Zoning, access, or platting challenges

- Unincorporated or agricultural land

- Investment properties needing rehab or with tenant complexity

If a lender told you “this doesn’t qualify,” Hopkins may say “let’s take a closer look.”

Why Private Money Lending Works When Banks Don’t

Why Private Money Lending Works When Banks Don’t

Banks follow rigid underwriting formulas based on Fannie Mae and Freddie Mac rules. If your deal doesn’t fit in their predefined box, it’s often an automatic “no.”

At Hopkins, we evaluate:

- Real property value and borrower equity

- Exit strategy or repayment plan

- Borrower experience and financial position

- Common-sense deal logic, not red tape

We’ve been doing this for over 40 years—and we’ve built our success by helping others fund deals that don’t fit the mold.

Who We Serve

Who We Serve

Our clients include:

- Real estate investors who need fast, reliable capital

- Self-employed borrowers with non-traditional income

- Buyers competing with cash offers or facing deadlines

- Landowners and developers with projects in early stages

- Homeowners or business owners refinancing or pulling equity

We serve all of Idaho and any other state where no mortgage broker/lender license is required.

Creative Loan Structures for Non-Traditional Properties

Creative Loan Structures for Non-Traditional Properties

Hopkins Financial provides:

- Private money loans on unconventional real estate

- Bridge loans for fast acquisition or interim financing

- Cash-out refinancing and equity-based funding

- Cross-collateral loans secured by multiple properties

- Flexible terms—short or long, depending on your needs

We build the loan around the deal—not the other way around.

We Close in Days, Not Months

We Close in Days, Not Months

Forget 45- to 60-day timelines. Our typical funding window is 7 to 30 business days, and we can often close even faster when needed.

If your lender pulled out, stalled, or you’re up against a deadline, Hopkins can step in and get it done—fast.

Where We Lend

Where We Lend

Hopkins Financial is headquartered in Idaho and serves:

- All counties and markets in Idaho

- Any U.S. state that does not require a mortgage broker or lender license

We know the local markets. We know how to evaluate tough deals. And we know how to close loans that other lenders simply can’t.

Let’s Talk About Your Real Estate Deal

Let’s Talk About Your Real Estate Deal

If your property is unconventional—or your situation doesn’t fit the bank’s guidelines—talk to us. We specialize in asset-based private money lending that helps borrowers succeed, regardless of red tape.

![]() 208-467-5467

208-467-5467

![]() www.hopkinsfinancial.com

www.hopkinsfinancial.com

Hopkins Financial. When the banks say no—we think outside the box and find a way to say yes.