News

Grateful for Hard Money: Why We’re Thankful for Our Clients This Thanksgiving

As Thanksgiving approaches, all of us at Hopkins Financial Services are reflecting on what we’re most grateful for—the clients who trust us with their real estate financing needs. From homeowners and investors to business owners and builders, you’ve chosen to work with…Read more

How Much Money Do I Need to Buy a House?

Understanding the Real Costs — and How Hopkins Financial Can Help When Banks Can’t Buying a home is one of life’s biggest milestones — but for many buyers, qualifying for a traditional mortgage can be the hardest part. Most people…Read more

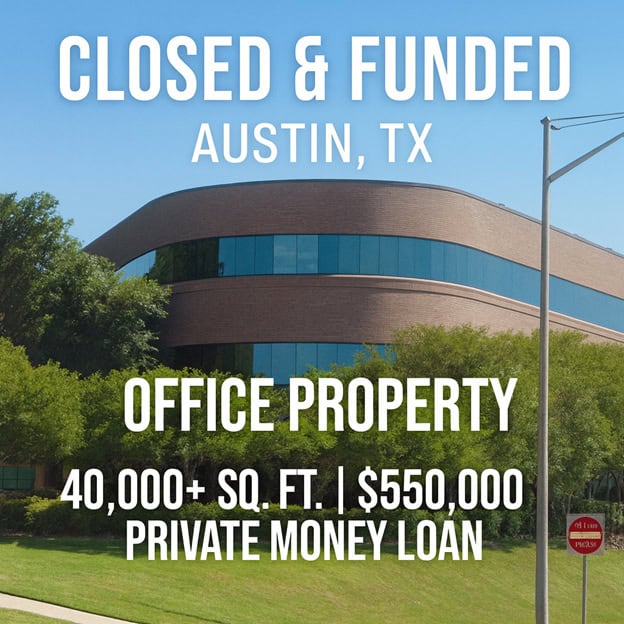

Closed & Funded: Hopkins Financial Powers $550,000 Private Money Loan for Austin, TX Office Acquisition

Strategic Financing for a Unique Opportunity Hopkins Financial is proud to announce the successful closing and funding of a $550,000 private money loan to facilitate the acquisition of a 40,000+ square-foot office building with an attached parking garage in Austin, Texas. The property, formerly occupied…Read more

Financing Rural Idaho: Lending Beyond the City Limits

Idaho’s Wide-Open Opportunity — and the Financing Gap From Emmett to McCall, from Buhl to Melba, Idaho’s wide-open spaces continue to attract buyers, investors, and families looking for freedom, acreage, and opportunity. Whether it’s a home on ten acres, a…Read more

Why Private Money Lending from Hopkins Financial Could Be the Key to Navigating Idaho’s 2025 Real Estate Market

After several years of rising mortgage rates, the tide is finally starting to turn. In fall 2025, 30-year mortgage rates have eased to their lowest levels in about a year — hovering near 6.25% after peaking well above 7.5% in late 2023. But while…Read more

Government Shutdown 2025: What It Means for Mortgages — and Why Private Lending Through Hopkins Financial Services Isn’t Affected

As of October 1, 2025, the U.S. federal government is officially in a shutdown — leaving many borrowers, real estate professionals, and lenders scrambling to understand what this means for real estate transactions and mortgage approvals. At Hopkins Financial Services, we’ve navigated government shutdowns…Read more

Late-Summer Rate Dip Sparks Market Movement — But Private Lending Still Has a Vital Role

Mortgage rates may have edged up last week, but their steady slide over the summer had a powerful effect: buyers are back, and refinance activity has surged. For real estate professionals and borrowers alike, it’s a sign that confidence is returning —…Read more

10 Real Estate Deals That Would Make a Bank Run — But We Funded Them Anyway

Creative Financing for Real-Life Borrowers Who Needed a “Yes” At Hopkins Financial Services, we’ve built a business on saying yes when banks say no. From unconventional properties to borrowers with bruised credit, we fund real estate deals that don’t fit inside the traditional lending…Read more